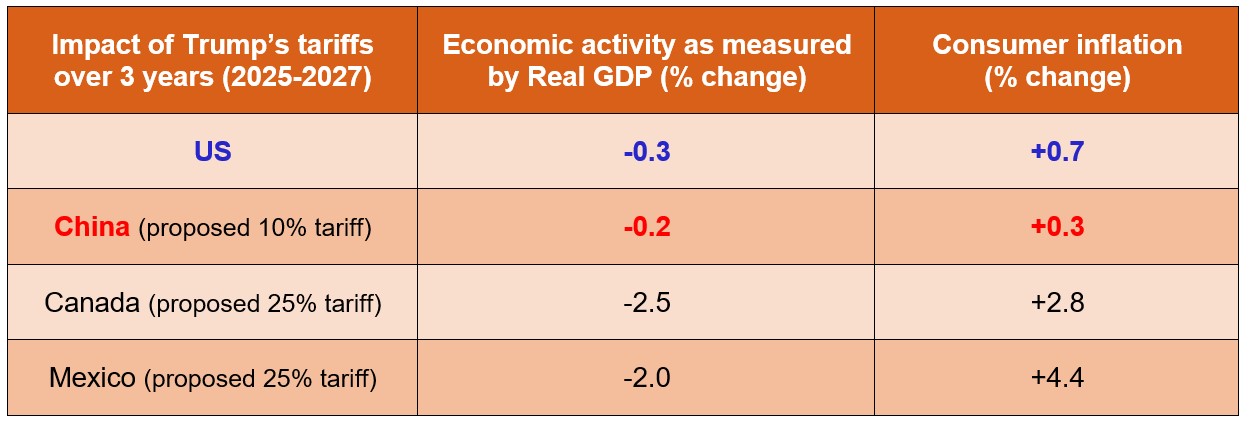

For China, the impact on economic activity of -0.2% over three years for a 10% tariff (Table 1) appears similarly mild. However, we need to double this GDP impact to circa -0.4% given Trump raised China’s tariff to 20% on 3 March. For Canada and Mexico, the impact is more severe with declines of 2.5% and 2% below potential GDP, respectively. As the Peterson Institute notes “these figures likely underestimate the real damage to the three economies (US, Canada and Mexico), which are highly integrated.”

Trump’s broader agenda beyond tariffs for the next few years is worrying investors

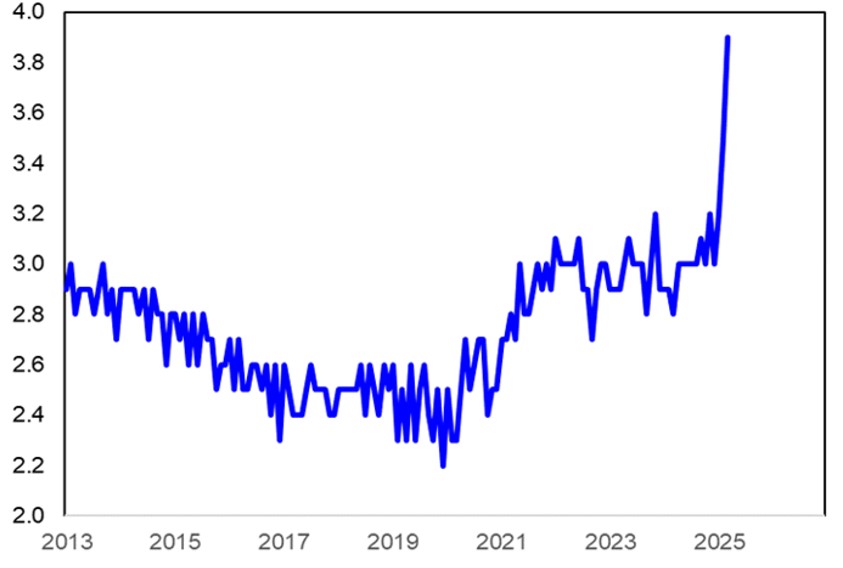

Even these economic estimates do not fully capture investors’ concerns about President Trump’s agenda for the next four years. The US Fed has recently signalled that US interest rates are on hold given the “uncertainty” over the impact of President Trump’s agenda. US Fed Chair Jerome Powell summed up the challenges in trying to work out what exactly is the Trump Administration’s agenda:

“Looking ahead, the new (Trump) Administration is in the process of implementing significant policy changes in four distinct areas: trade, immigration, fiscal policy, and regulation. It is the net effect of these policy changes that will matter for the economy and for the path of monetary policy.” 5

Hence the new reality is that investors have concerns on multiple fronts beyond tariffs. For example, President Trump’s campaign promise was for the “mass deportation of undocumented migrants” which could be between 1.3 million and 8.3 million people. This would reduce the US labour supply in critical industries such as agriculture where 40% of the workforce is estimated to be ‘undocumented migrants’. Hence there is further upside risk to US inflation.

Then we have the phenomena of the Trump’s Department of Government Efficiency (aka ‘DOGE’). DOGE is currently being run by the renowned part-time Tesla car manufacturer and Space X ‘rocket man’ Elon Musk. Trump has claimed that DOGE has already identified "hundreds of billions of dollars of fraud" and that Musk will lead the charge to find US$1 trillion in savings by cutting government spending. Neither Trump nor Musk have provided any compelling evidence of significant fraud6. DOGE is another dark cloud for US economic growth by signalling a reduction in government jobs and spending over the next four years.

Finally, we have Trump’s executive order to reduce government regulations. This “Unleashing Prosperity Through Deregulation” mantra requires regulators to identify at least ten existing regulations for repeal when proposing a new regulation. Regulators must ensure that the net cost of all new regulations are “significantly less than zero.” 7 This is a further example of the diminishing role of the US Federal Government planned under Trump.

Clearly the current Trump agenda - higher tariffs that impose more difficult trading conditions for the global economy, lower US immigration and population growth with “mass deportations,” more restrictive US fiscal policy with cuts to government jobs and spending as well as the less regulatory involvement - is not a recipe for predictability and stability.

Remarkably tariffs are being applied to the close allies of the US in terms of Canada and Mexico as well as Europe and Australia. Contrast this with the way America’s adversaries are being treated.

Russia is now seemingly a new best friend and Ukraine is a threat to starting ‘World War 3’. This overlooks the reality that Russia began the Ukrainian war by invading Crimea back in 2014 and then assaulting eastern Ukraine in February 2022.

To call this as just the “Art of the Deal” is generous. President Trump’s impulsive decision-making can reasonably be regarded as both a threat to the global economy as well as American political leadership in the world.

The new US President certainly has a “passionate intensity” that W.B. Yeats referred to in the “Second Coming”, leaving the world’s economic and political structures hostage to his impulses.