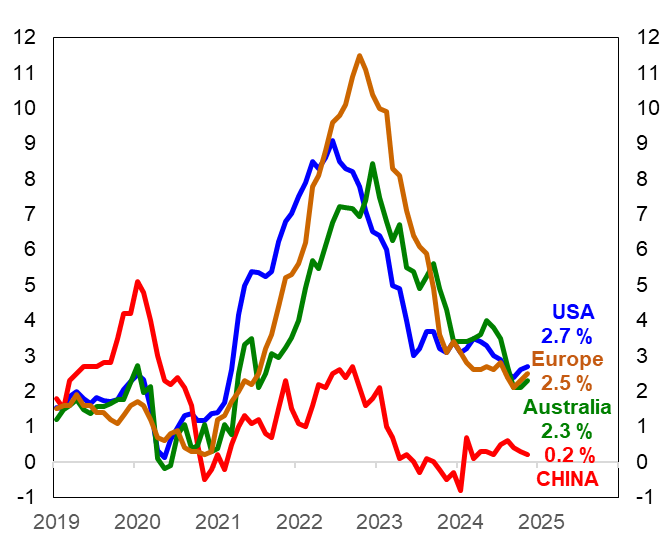

Yet consumers around the world remain angry with the “cost of living.” There are still persistent price pressures in health care, insurance and rents that continue to squeeze consumers budgets. Consumers expressed this anger at the ballot box in 2024. Notably there were either changes in governments (witness Britain, France and the US) or voters chose to scale back their support for the incumbent government (witness India and Japan). This serves as a warning for those governments that are seeking re-election in 2025 in terms of Australia, Canada and Germany.

While Australia’s inflation fell to 2.3%, in the year to November 2024, this moderation in price rises largely reflects the benefit of government electricity subsidies. According to the Australian Bureau of Statistics (ABS), “electricity prices fell 21.5 per cent in the 12 months to November”1. Even with lower electricity prices, the struggle to keep food on the table and a roof over our heads continues. Egg prices increased by 11.6%, insurance costs by 11% and rents by 6.6% in the past year. If you wanted to take a holiday from these rising prices, the cost of domestic travel increased by 4.9%.

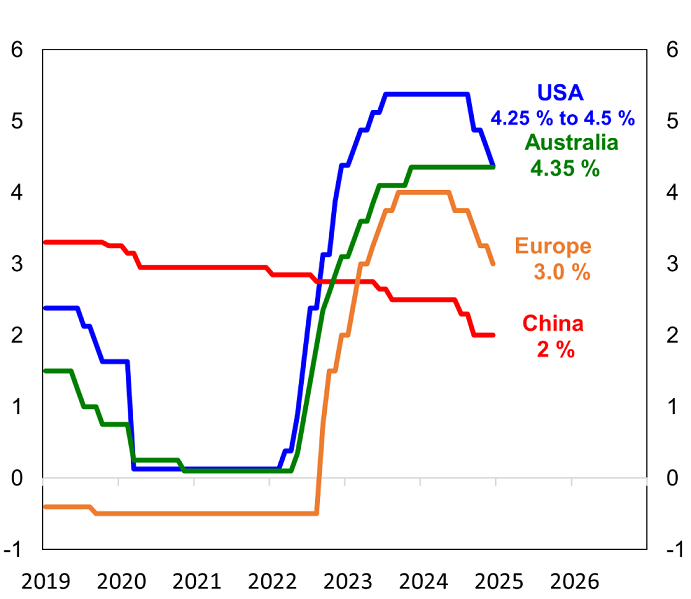

Chart 2: Global central banks reduced interest rates but Australia was an exception

Sources: Federal Reserve Economic Data (FRED) St Louis Fed and LSEG DataStream.

Another encouraging sign is that global interest rates are finally falling (Chart 2). Most central banks are lowering their cash interest rates given that inflation is heading back to their circa 2% targets. The most prominent central banks lowering interest rates were the European Central Bank and US Federal Reserve with both cutting interest rates by 1% in 2024. China’s central bank was more cautious only cutting interest rates by 0.5%. The clear exception to this global shift to lower interest rates is the Reserve Bank of Australia (RBA) which has kept interest rates at 4.35% since November 2023.

Apart from surprising election outcomes across the globe, the past year also provided dramatic and terrible events. The Middle East remains cursed by brutal violence. The conflict between Hamas and Israel continues in Gaza while Israel and Iran have exchanged missiles and threats. Russia’s devastating invasion of Ukraine in 2022 is still casting a shadow over Europe and remains a threat to political stability. Fortunately, Ukraine’s brave defence has ensured a stalemate against the larger Russian armed forces.

The astonishing election of Donald Trump as the next US President has the potential to see more dramatic twists and turns in 2025. Trump’s campaign promises such as the imposition of large tariff increases for China and Europe and the mass deportation of illegal US immigrants could provide significant shocks for global economics and politics in 2025. The global economy and financial markets are likely to be tested by the ‘new’ US President with a capacity to shoot from the hips as well as the lips.

The global economy has provided both positive and negative surprises in 2024

Global economic activity has been ‘multi-speed’ in the past year. The US economy remains the primary source of strength. American business and consumers kept spending despite the headwind of higher interest rates. Strong jobs growth allowed the unemployment rate to remain stable at around 4% and supported solid wages growth. Notably the US economy recorded annual gross domestic product (GDP) growth of 2.7% in the year to September 2024 compared to potential growth estimates of around 1.8%. Hence the US is punching well above its heavyweight status in the global economy.

By contrast, European economic growth was only 1% over the past year. Germany has struggled given weaker global demand for their luxury cars and chemicals. The United Kingdom modestly improved from their post 2016 Brexit malaise but is still characterised by low business investment and poor weather.

China’s economic growth in the past year remains constrained by a cautious consumer and weak property market. Falling property construction activity and apartment prices undermined confidence in China’s economy. Amongst Australia’s other major trading partners, economic growth has also been disappointing. Japan also struggled with subdued consumer spending and weak exports. India’s economic growth slowed to 5.4% in the year to September 2024 compared to 7.8% in 2023.

Australia’s economic performance is a mix of the extraordinary and the ordinary

The negative impact of inflation, high mortgage interest rates and rising rents has generated a very ‘painful squeeze’ for Australian consumers. Australia’s sluggish economy was confirmed with a weak GDP result for the September quarter. Australia’s economy expanded by only 0.3% and 0.8% for the past year. Essentially economic activity is barely registering a pulse. Notably Australia is in a ‘per capita’ recession where population growth exceeds economic growth. Yet there is a ‘silver lining in this dark cloud’ judging by RBA commentary in December. The RBA now appears more open to cutting interest rates in 2025 given the "softer than expected" Australian economic activity and recent milder inflation results.

In even more encouraging news, Australia is recording strong jobs growth. In the year to November, circa 388,000 new jobs were generated in Australia. The ABS noted that “Health care and social assistance continued to be a key driver of labour market strength”2 with an annual growth of 11.4%. However there has also been a rising number of workers holding “multiple jobs” in the past two years. The ABS estimates that 6.6% of workers are now juggling different jobs. Hence, this “cost of living” crisis is exacting a high toll.

The key benefit of this strong jobs market is that Australia has a low unemployment rate of 3.9% and wages growth is solid. Notably wages growth was 3.5% in the year to September which is higher than inflation. Finally, Australian workers are starting to see that their pay packet increases are outpacing rising consumer prices.

A strong year for share returns

Global shares delivered very strong returns in 2024. Optimism over the promise of Artificial Intelligence (AI) as well as progress towards lower global inflation and interest rates were the major positive drivers of global share markets. This comes despite the tragic Russian-Ukraine War, the Hamas-Israel conflict and the concern that these tragic events could escalate further.

Global shares (hedged) recorded a 19.6% return for the year in local currency terms. Given the weakness in the Australian dollar over the past year, global share (unhedged) delivered an exceptionally strong 29.5% return.