MLC Low Cost gives your clients access to low-cost returns from investment markets through blend of index, enhanced index and active investment strategies. The investment options are invested across a wide range of assets in and outside Australia.

-

MLC Low Cost

Conservative BalancedMLC Low Cost

Balanced

MLC Low Cost

Growth

Objective Aims to:

- deliver returns that exceed changes in the costs of living, over the long term, and

- reduce risk in the investment options when we consider risks are too high.

Asset mix*

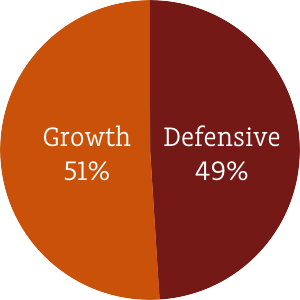

Total growth assets: 40-60%

Total defensive assets: 40-60%

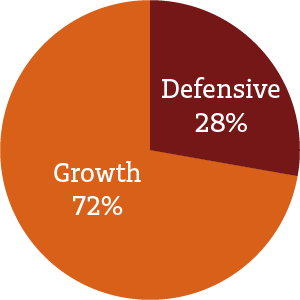

Total growth assets: 60-80%

Total defensive assets: 20-40%

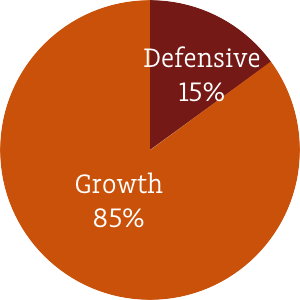

Total growth assets: 75-95%

Total defensive assets: 5-25%May suit your clients if they want a diversified, low cost investment options with… - Some long-term capital growth

- An investment time frame of at least five years

- Long-term capital growth

- An investment time frame of at least seven years

- Long-term capital growth

- An investment time frame of at least seven years

* Strategic asset allocations as at 1 October 2024 for the MLC Low Cost Conservative Balanced, MLC Low Cost Balanced and MLC Low Cost Growth investment options.

-

Well-diversified investment options

The MLC Low Cost investment options are well diversified both across asset classes and the investment managers we appoint. Our managers invest in thousands of companies and securities around the world across Australian and global shares, infrastructure, property securities and fixed income.

Index investing to keep costs low

Many of the investment options' investments are in cost-effective index or enhanced index strategies. We use these approaches for shares and property securities.

Active investing where it matters most

We use active managers in asset classes where it can make an important difference to returns or risks without substantially increasing fees. In particular, we actively manage fixed income investments.

Expert management of the asset mix

Many low-cost investment funds take a ‘set and forget’ approach to asset allocation. In the MLC Low Cost investment options, our experienced investment team actively manages the asset allocation. Your clients benefit from the asset allocation insights of MLC’s expert Capital Markets Research team, which has managed MLC’s multi-asset investment options since 2005, for a much lower cost than in a fully active fund.

Choice of three investment options

Select the MLC Low Cost investment option with the right asset allocation and investment timeframe to help your clients achieve their financial goals.You can use the investment option as your clients’ complete investment portfolio or as the core, adding other investments.

Investing with MLC

MLC is one of Australia’s most experienced investment managers.We’ve successfully managed multi-asset funds for more than 35 years and the MLC Low Cost investment options have provided strong returns since they began in 20111, so you know you’re in good hands.

1Based on since inception returns for the MLC Index Plus portfolios in MLC MasterKey Super & Pension Fundamentals. In May 2023, MLC Index Plus portfolios within super and pension were renamed MLC Low Cost. Past performance is not a reliable indicator of future performance. The value of an investment may rise or fall with the changes in the market.

-

The investment options are available through:

- MLC MasterKey Super & Pension Fundamentals

- MLC MasterKey Business Super

- MLC MasterKey Personal Super

- MLC MasterKey Term Allocated Pension