We use cookies to improve your experience on our website. By continuing, you acknowledge that cookies are being used. To find out how to manage or opt out of cookies visit the cookie notice.

- Personal

- Retirement

- Personal deductible contributions

Claiming a tax deduction

How to claim a tax deduction on your personal super contributions

How does it work?

If you have money left over from your after-tax pay or savings, adding to your super can help you have more in retirement. The money you add is called a personal super contribution or voluntary contribution.

What are the benefits?

By taking control of your super and making personal super contributions, you could boost your retirement savings and may enjoy potential tax benefits. Your super contributions are normally taxed at up to 15%1, where you could pay up to 47% tax on earnings outside of super.

How do I claim a tax deduction?

- Log in to your MLC Online account. You can also register for an account if you don't already have one.

- Fill out the Notice of intent to claim form and submit. You'll then receive confirmation that your form has been submitted and we've notified the ATO.

- Wait to hear from us. In some cases it can take up to five business days to process your claim. If valid, you'll receive an acknowledgement email or letter.

- You need this before claiming your tax deduction.

- When you submit your individual tax return you need to enter the amount you've claimed in the supplementary section.

- Download the Notice of intent to claim form and fill it in on your computer or phone then print and sign the form.

- Send us the completed form by email to contactmlc@mlc.com.au, or you can mail it to: MLC PO Box 200 North Sydney NSW 2059.

- We'll submit your form to the ATO and send you an acknowledgement email or letter once the claim is complete. In some cases it can take up to five business days for the ATO to process your claim.

- When you submit your individual tax return you need to enter the amount you've claimed in the supplementary section.

Need some help?

If you have any questions please speak to your financial adviser, or you can chat with one of our friendly team by clicking on 'message us' below, or call us on 132 652 Monday to Friday.

Case study

Bob is 55 years of age and earns $80,000 p.a., so his marginal tax rate is 32%2. He’s paid off his mortgage and plans to retire in 10 years – so he wants to contribute more to his super.

He makes a personal super contribution of $10,000 and claims the amount as a tax deduction – reducing his taxable income. This means he pays $3,200 less tax in his tax return. Meanwhile, tax of 15% ($1,500) is deducted from the contribution in the fund.

By using this strategy, Bob increases his super balance and makes a net tax saving of $1,700 (that is, $3,200 less the $1,500 tax he paid within his super fund).

Things to keep in mind

- To make personal super contributions you must be eligible to contribute to super.

- To claim a personal tax deduction for your contribution, other eligibility conditions apply, including a work test from age 67 – see the Australian Tax Office (ATO) website for more information

- Personal super contributions count towards your concessional contributions cap and penalties may apply if you go over the cap. You can check your available cap by logging into your myGov account and linking the ATO service.

- To claim the super contribution as a tax deduction, you need to submit a valid Notice of Intent form with your super fund, and receive an acknowledgement from them, before you complete your tax return, start a retirement income stream or withdraw or rollover the money.

- If you’re an employee, another way to boost your super tax-effectively is to make salary sacrifice contributions.

- You can’t access your super until you meet a condition of release such as reaching age 60 and retiring.

FAQs

-

To claim a tax deduction on personal super contributions, you’ll need to provide your super fund with a Notice of intent to claim form. This form is available when you log in to your MLC Online account, or you can download the form here.

-

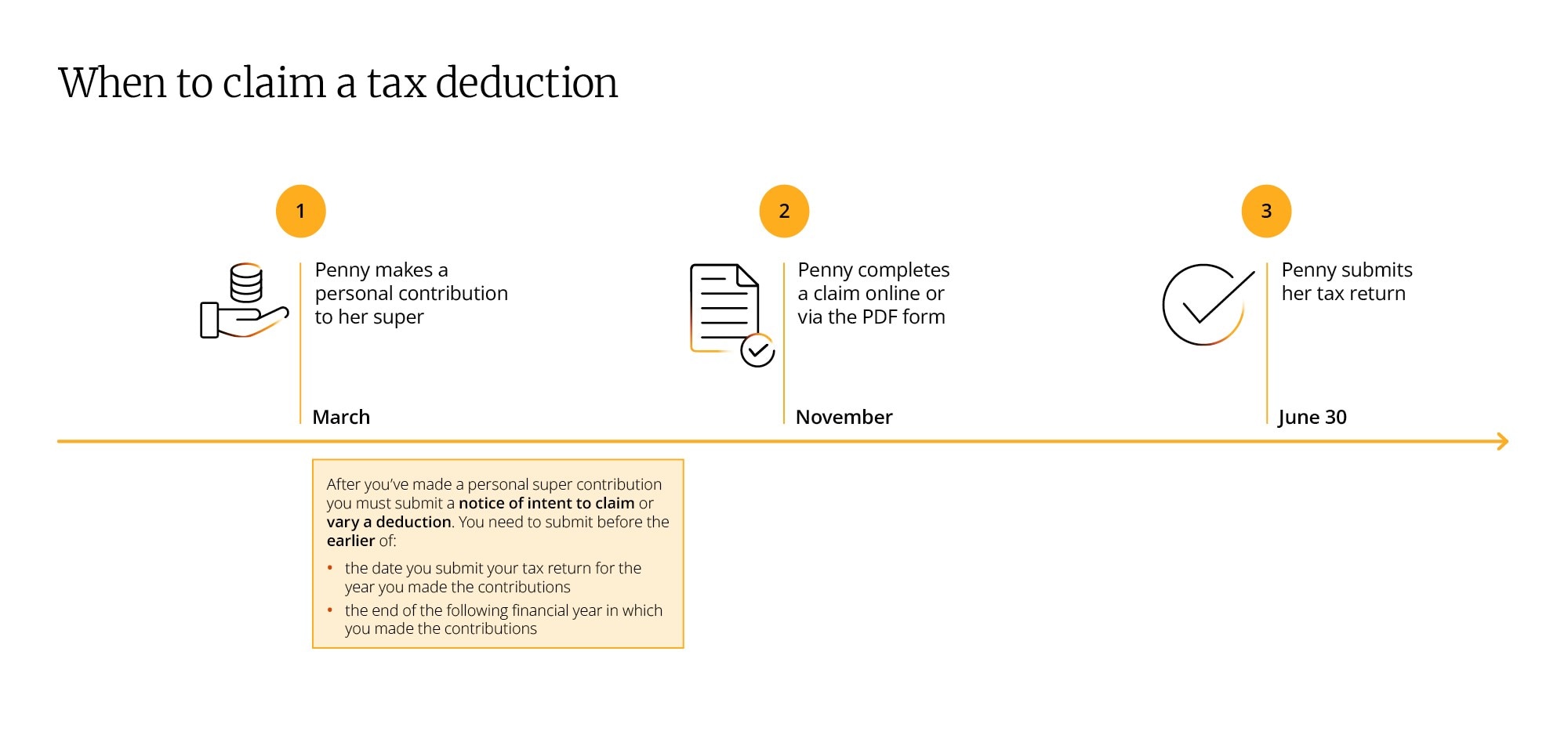

After you have made a personal super contribution you must give your super fund a notice of intent to claim or vary a deduction by whichever comes first -

- the date you submit your tax return for the year you made the contributions

- the end of the following financial year in which you made the contributions

If you plan on commencing an income stream with any of your funds, or making a withdrawal from your account, it’s important that you lodge your Notice of Intent to claim form before doing so to ensure you’re eligible to claim a deduction.

-

You might be able to claim a tax deduction on your personal super contributions if:

- You're aged under 75 at the time of the contribution

- You meet the work test if you’re aged between 67 and 74 when the contribution was made

- You're an MLC Super member

- You have provided a notice of intent to your super fund which has validated and the fund has provided you with an acknowledgement

- You haven't opened a pension or transition to retirement account using all or part of the contributions you intend to claim as a tax deduction

For more information about eligibility to claim visit the Australian Tax Office (ATO) website for more information.

-

If you’re eligible for a tax deduction, the contribution is taxed at 15%, where as you may pay tax on your income up to 47% (including the Medicare Levy). Higher income earners (with income from certain sources of $250,000 or more) are taxed at 30% on contributions. Personal super contributions can also reduce your taxable income.

-

Personal super contributions you claim a deduction for are concessional contributions. A cap applies which limits the amount of concessional contributions you can make without having to pay extra tax. This cap is $30,000 for the 24/25 financial year. If you don’t use all of your cap, you can carry it forward for up to five years. If eligible, this could help you to make even larger concessional contributions in a future year. These are called catch-up contributions.

-

Log in to your MLC Online account to see a summary of your personal contributions and withdrawals. You'll have an opportunity to review these prior to submitting your Notice of Intent to Claim form.

-

Yes, you can make more than one claim for tax deductions on super each year. If you decide to make some extra contributions to your super before July 1 and would like to claim this amount you simply need to submit another Notice of intent to claim form. Remember to wait until you receive the acknowledgement letter before submitting your tax return.

-

If you want to reduce the amount you claimed you can vary your notice of intent to claim, you will find this option on the Notice of intent to claim form. If you want to increase the amount you intend to claim you simply need to submit another Notice of intent to claim form with the additional amount you want to claim.

-

Usually, your super fund and employer will automatically report your super balances and contributions to the ATO. If you're claiming a tax deduction for super contributions, you list the amount you're allowed to claim as a deduction in your tax return. You can check this with your accountant or tax agent at tax time.

Disclaimer 1 Individuals with income from certain sources above $250,000 in a financial year will pay an additional 15% tax on all or part of their salary sacrifice and other concessional super contributions within the cap.

Disclaimer 2 Includes Medicare levy

Got a question?

Get set in the right direction with help and guidance available over the phone, online or face-to-face.

General advice and information only

Any advice and information on this website is general only, and has been prepared without taking into account your particular circumstances and needs. Before acting on any advice on this website you should assess or seek advice on whether it is appropriate for your needs, financial situation and investment objectives.

Tax disclaimer

Any general tax information on this website is intended as a guide only and is based on our general understanding of taxation laws. It is not intended to be a substitute for specialised taxation advice or an assessment of your liabilities, obligations or claim entitlements that arise, or could arise, under taxation law, and we recommend you consult with a registered tax agent.

Insignia Financial Ltd ABN 49 100 103 722.